AtomicPay’s CEO believes that scams and volatility are the primary things holding back public mass adoption of cryptocurrencies.

The Thailand-based company is a non-custodial crypto payment processor. They are one of the few crypto payment processors that facilitates payments for multiple cryptos without holding merchant funds in escrow and charging a fee before releasing funds. AtomicPay charges 0.9% at the end of every month that their service is used. Rather than demanding a percentage of every sale at the time the sale is settled, they issue a bill.

CEO Benz Rif tells CCN in a recent interview that they very much rely on an “honor system.” Importantly, he says they haven’t had any problems with people failing to pay fees.

Founded Out of High Fee Woes

Rif says that he created the company after paying as much as 13% to Paypal. Domestic users based in the US may not experience such high fees, but when all is said and done, for companies operating in places like Thailand, PayPal and currency conversion fees top 10% routinely. He says his company tried to use Bitpay but ran into similar problems there.

Back in 2017, I was doing a lot of online business. Before we used BitPay, we used Paypal. So what happens with Paypal is, let’s say a customer pays us $100. At the end of the day we only get $86 or $87. So I decided to move to cryptocurrencies. When we tried Bitpay, it was around 8%. What they advertised was 1%. There are other charges like withdrawal fees, EFT when you do a bank transfer across borders, and other fees. So I was sitting down with friends and we decided to create something different.

AtomicPay enables its users to accept crypto payments directly. They use an in-house wallet software which enables them to know how much revenue a company generates in a month. It enables merchants to issue as many addresses as necessary for customers. Companies receive the funds directly and could theoretically skip out on the bill, but this doesn’t happen.

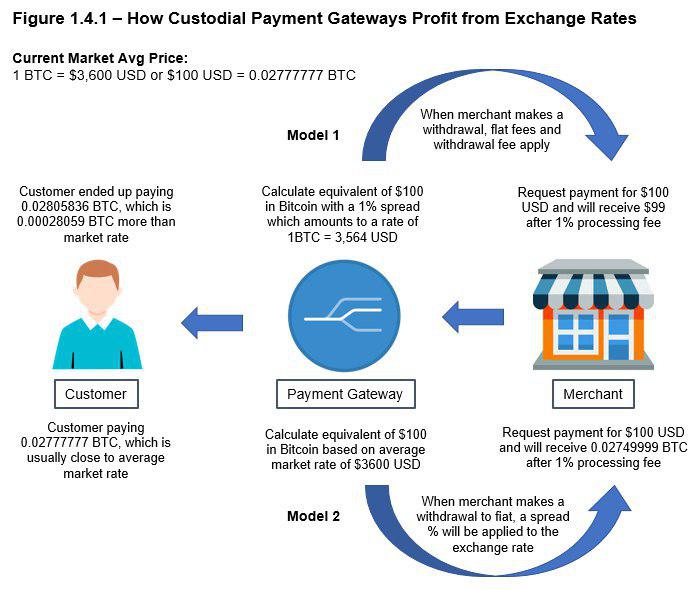

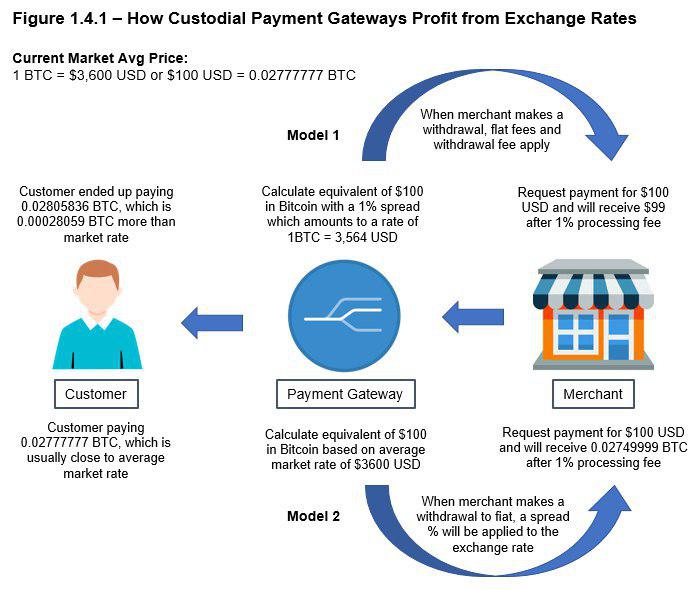

Rif is working on a whitepaper that discusses the problems for merchants with the existing centralized payment processing model. He provided the following infographic as a visual aid to explain the issue of exchange rates and centralized models.

Rif is working on a whitepaper that discusses the problems for merchants with the existing centralized payment processing model. Source: Benz Rif

Non-Custodial Services Are More Decentralized

Besides the simple desire to improve user ability to receive cryptocurrencies, Rif says the company wanted to build something more in line with the principals of decentralization than was currently available.

The majority of crypto payment processors hold funds and charge fees for withdrawal. An advantage to a non-custodial service is that AtomicPay doesn’t fall under certain new regulations in Thailand which would otherwise see his firm as a money services provider or essentially the same thing as a bank.

If you hold funds for any length of time, you are liable to be regulated as a financial institution.

Clients in Thailand and Venezuela have access to various exchanges which will conveniently convert their proceeds to fiat for them.

The service is not yet supporting Ethereum publicly. Rif says that the company has offered Ethereum to some private customers who asked for it, and they have experienced problems with in-person transactions taking too long to settle.

The majority of AtomicPay’s merchants to date have been in Venezuela and Colombia, thanks to the help of efforts by the Dash community.

Scams and Volatility Leading Issues With User Adoption

As discussed in a recent interview with Edge wallet’s Paul Puey, merchant adoption of crypto is nowhere near where we’d have expected it to be from a vantage point of 2014. Being that Benz Rif’s company works directly on merchant adoption, we asked him what he thought were the contributing factors to slow merchant adoption.

The amount of money in e-commerce is around $2.8 trillion. But Bitpay itself is only like $1 billion. So we are so far away. But for years we were convinced that one day cryptocurrencies would be the future of digital payments.

Chainalysis did a report on crypto payment processors, and they saw a decline in 2018 by 80%. So I did more research.

Alone in 2018, we saw more hacks and scams than we have seen over the past 10 years. There are so many hacks, so many scams, it creates a distrust among the general public.

I asked my wife, I asked my friends: why don’t you guys use cryptocurrencies? They told me this very simple issue. ‘We can’t trust that with all this news on it.’ Unless we can solve this issue, we will never form a trust among general merchants and people.

Rif also believes that volatility is a hard problem for merchants to deal with. If you sell something for $100 and the following day the payment is only worth $80 or even less, you’ve got a problem that creates excess costs. The emergence of stablecoins might help to deal with this side of the equation, but ultimately volatility is part of the process in crypto markets.