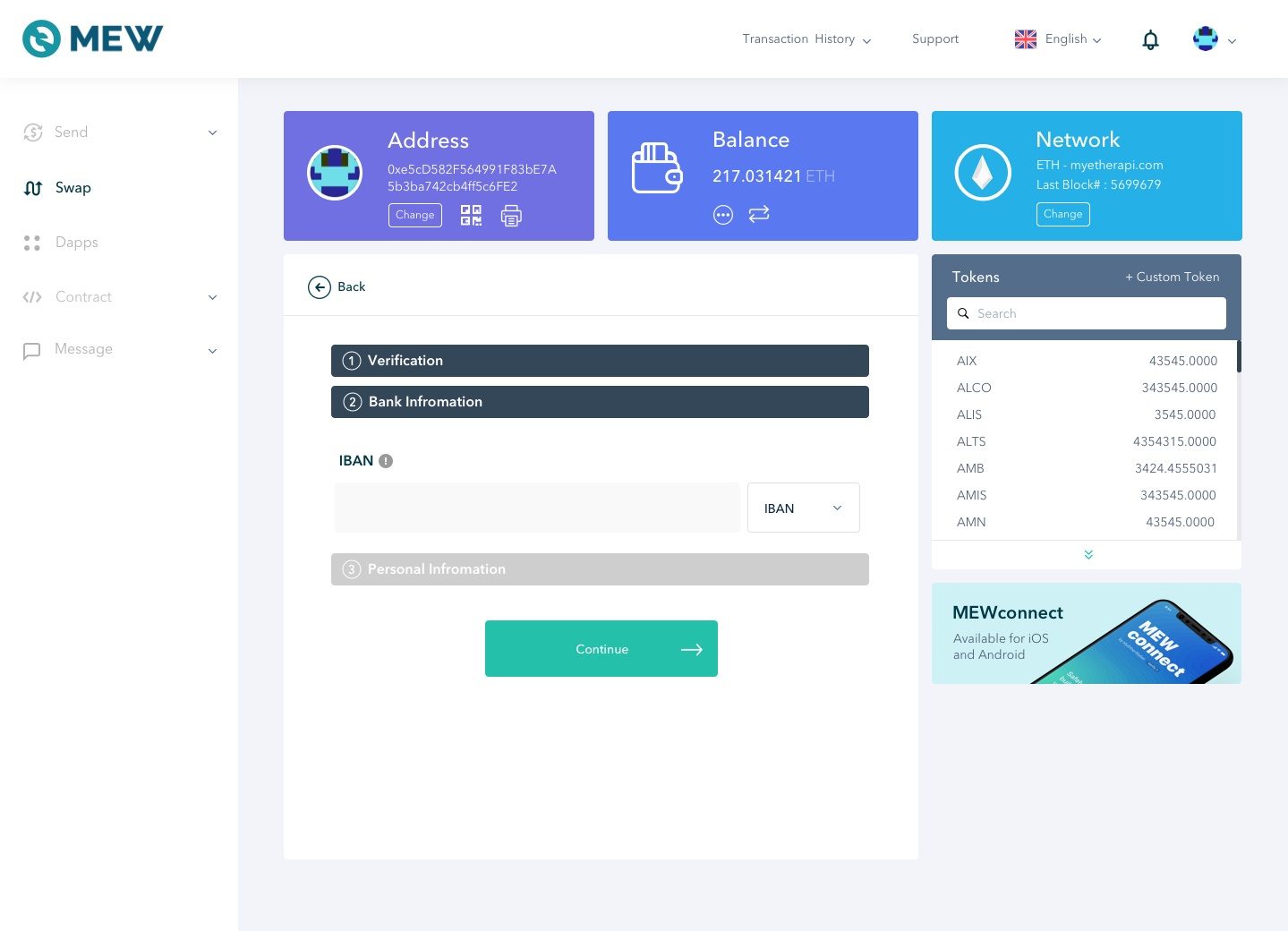

Europeans now have a new option to convert Bitcoin and other crypto assets into fiat without having to undergo identity verification. To make this possible, Swiss service Bity integrated with MyEtherWallet to enable the seamless transition of funds between MEW wallets and Bity accounts.

Swiss Crypto Firm Sheds KYC Requirements for $5,000 Purchases

Switzerland has gained a reputation as a haven for crypto firms. | Source: Shutterstock

Bity supports movements of up to 5,000 CHF (roughly $5,000) without a KYC verification process. According to a press release, Bity is a totally legal service under Swiss laws.

The company writes:

“Bity is able to offer this KYC-less Exit-to-Fiat gateway because it is compliant with the Swiss Anti Money Laundering Ordinance (AMLA). Bity is a regulated and audited financial intermediary within Switzerland.”

Calling the service “Exit-to-Fiat,” Bity’s option is now available in the fifth version of MyEtherWallet. The exchange service supports Ether, Bitcoin, Euros, and Swiss Francs.

In addition to its online services, Bity operates a number of Bitcoin ATMs in Switzerland. They have locations in Zurich, Zug, Winterthur, Basel, and Lausanne.

Fleeing to Fiat Without Intrusive Regulations

Know-Your-Customer laws have widely been viewed as a barrier to crypto adoption. Until recently, customer verification was an onerous and difficult process. Some companies and customers still take days to get on board, while others have contracted with providers who are capable of verifying identification in minutes.

Money laundering is viewed as a key concern around cryptocurrency, with privacy coins such as Monero getting an especially bad rap in relation to the practice. Senator Charles Schumer once said of Bitcoin:

“It’s an online form of money laundering used to disguise the source of money, and to disguise who’s both selling and buying the drug.”

However, overall, cash is still very much king when it comes to money laundering. Up to $2 trillion in illicit transfers take place via regular banks annually. The public nature of the blockchain makes it a less attractive option for money laundering than traditional cash. Money laundering is even more difficult with blockchain analytics companies growing and servicing governments and exchanges with intelligence about their users’ transactions.

MyEtherWallet also announced the integration of Changelly, a ShapeShift-alternative that doesn’t require KYC for some transactions. The company primarily facilitates token swapping and is integrated in several other wallet services, like Edge Wallet, as well.

Lacking KYC is perhaps good advertising, but there are obvious drawbacks. For one thing, the $5,000 limit is just over 1.2 BTC at present. Serious traders will be more interested in higher limits, which Bity also supports – after a verification process.

Alongside online brokerages, physical Bitcoin ATMs are increasingly available, complementing services like LibertyX, which enables merchants to process Bitcoin sales for US customers. Many Bitcoin ATM’s offer a two-way service — you can buy and sell crypto through them. Most require some form of abbreviated KYC process, which involves scanning your ID card.

Featured Image from Shutterstock